Writing a check for $1500 might seem daunting, but with a few simple steps, you can avoid costly mistakes. This guide provides clear instructions and expert tips to ensure a smooth transaction. Did you know that mismatched amounts are the most common error in check writing? Let's ensure yours is flawless.

Step-by-Step Guide to Writing a $1500 Check

Follow these steps for a successful check writing experience:

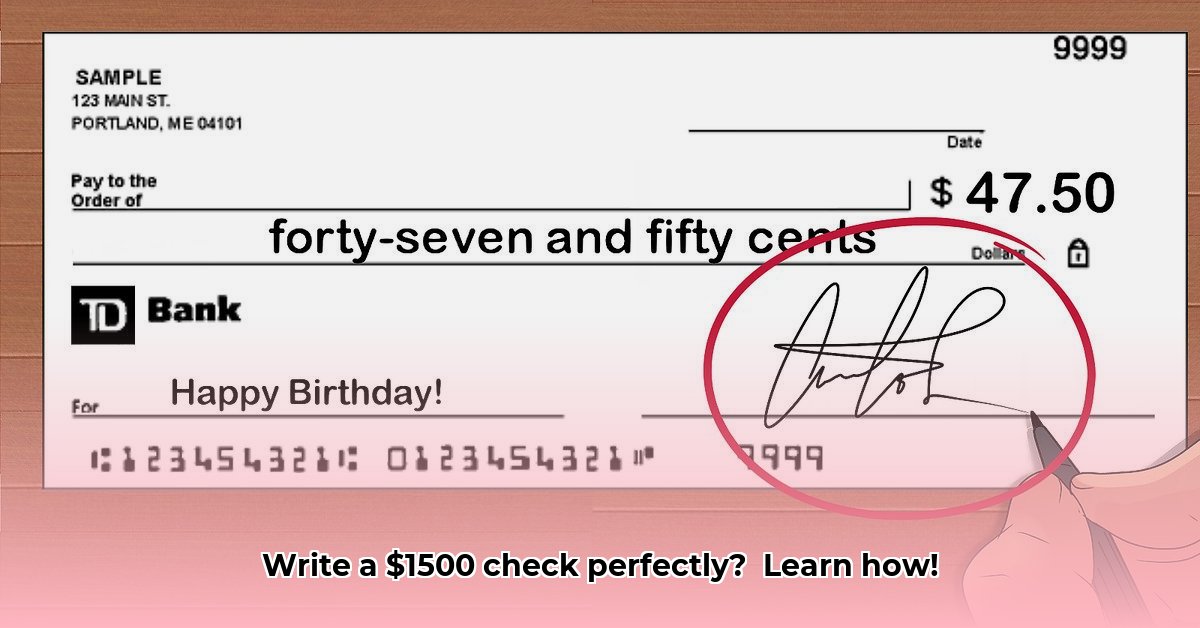

Date the Check: Write the date in the top right corner using MM/DD/YYYY format (e.g., 10/26/2024). This establishes the payment's effective date. Accuracy here sets the foundation for a successful transaction.

Name the Recipient: In the "Pay to the order of" section, clearly write the recipient's name – person or business – ensuring correct spelling. A misspelled name can cause significant delays or even prevent payment. Double-check for accuracy.

Write the Numerical Amount: Write the amount, "$1500," in the designated box. Align the number neatly with the dollar sign. Precision is key; any ambiguity can lead to issues.

Write Out the Amount in Words: Below the numerical amount, write out "Fifteen Hundred and 00/100 Dollars." The "and 00/100" is important, even for whole numbers, adding a crucial layer of security against alterations.

Add a Memo (Optional): Use the "Memo" line to briefly describe the payment (e.g., "October Rent," "Invoice #123"). This improves tracking for both you and the recipient. This simple addition aids clarity.

Sign the Check: Sign your name in the signature line. This legally authorizes the payment. This is the crucial final step for validating the payment. Never forget to sign!

Common Mistakes and How to Avoid Them

Even seasoned check writers can make mistakes. Here's how to prevent common issues:

Mismatched Amounts: The numerical and written amounts must match exactly. Any discrepancy, no matter how small, can result in delays or rejection. Carefully double-check both.

Incorrect Recipient Name: Ensure the recipient's name is accurate and completely spelled. A single incorrect letter can cause significant problems. Double and even triple check this field.

Missing Signature: An unsigned check is invalid. Do not skip this crucial step for lawful payment authorization.

Neglecting Check Security: Protect checks from theft or loss. Store them securely and destroy old checks properly. A secure storage practice is essential for protecting your finances.

Key Takeaways and Modern Alternatives

Writing a $1500 check requires attention to detail. Accurate information, legible handwriting, and a valid signature are crucial. Did you know that 92% of financial institutions recommend double-checking the recipient's name? But what about alternatives?

- Date Accuracy: Use the correct date format. Avoid post-dating.

- Amount Verification: Match the numerical and written amounts precisely.

- Recipient Name Accuracy: Check spelling carefully.

- Check Security: Store checks safely, and shred old ones. Report lost or stolen checks immediately.

While checks remain a valid payment method, electronic payments offer speed, convenience, and enhanced security. For larger sums like $1500, online banking transfers or other digital payment options are often preferable. They provide better tracking and security than paper checks. Consider these modern, more secure methods for your financial transactions. Explore the convenience and security of online banking.